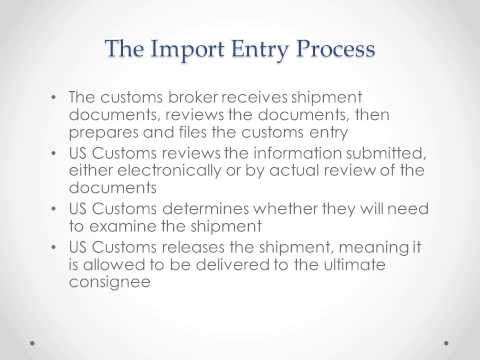

Feb 15, · U.S. Customs and Border Protection does not inform importers of the arrival of cargo or freight. When cargo or freight arrives at a U.S. port of entry, it is the responsibility of the shipper or a designated agent to inform the importer of its arrival Jan 12, · How you can hire a person or business to deal with customs for you. Customs agent or broker There are processes that can make clearing customs quicker and easier to manage if Jun 01, · Before you can get in on this $ million-dollar industry, you’re going to need to understand the laws and regulations for importing honey into the USA in the first blogger.com Food and Drug Administration (FDA) is the federal government agency in charge of regulating imports of food products into the United States, including honey.. There are several things that you will need to do

New Customs Legislation FAQs – South African Revenue Service

Customs clearing agent business plan the national COVID Online Resource and News Portal at www. za or see SARS COVID news items and tax relief measures here. Home » Customs and Excise » About Customs » New Customs Legislation FAQs. The Customs and Excise Act,has not kept pace with the changing focus of customs work or customs clearing agent business plan the radical changes to the environment in which international trade is conducted, particularly the rapid growth in the use of information technology and the exchange of electronic data.

In its current form, our customs legislation is unable to respond to new risks, it is furthermore not business friendly and also needs to be easier to understand and use in order to provide certainty to traders and travellers as well as to Customs.

The CCA and CDA are modern pieces of legislation aiming to simplify customs administration and to provide a platform for customs modernisation. They are aligned to the Constitution and were benchmarked against other customs administrations and international conventions such as the Revised Kyoto Convention, which aim to harmonise, secure and facilitate international trade.

The Acts provide end-to-end supply chain visibility for SARS, customs clearing agent business plan, due to mandatory electronic submission of communications, advance cargo reporting, improved sealing provisions and the requirement of various electronic notifications throughout the process.

The Acts are furthermore written in plain language and the material covered is arranged in a logical and systematic way, with topic-specific Chapters. The Rules also follow the arrangement of the Acts and each rule is linked to a specific enabling provision in the relevant Act.

This enables people to whom the Acts apply to find provisions applicable to specific subject matters, for example a specific customs procedure, in an easier manner. The Acts also support the National Development Plan to promote exports and business competiveness, stimulating domestic manufacturing and supporting SMMEs.

When the Acts are implemented, there will be an impact on all customs clients, particularly in relation to system, process and policy changes.

There will also be new compliance measures for traders and changes to the penalties regime. An example of the type of impact that the new legislative regime may have on trade can be illustrated by the Chapter on warehousing. Various stakeholders, including warehouse licensees, licensed carriers, importers and exporters, customs brokers and owners of goods and agents representing foreign clients will be impacted by the changes in the warehousing regime.

These changes include the following:. Reporting of information by third parties enables Customs to risk assess information about vessels, aircraft, trains, vehicles, customs clearing agent business plan, customs clearing agent business plan, crew and cargo entering or leaving the Republic. The benefits of the reporting requirements include the following:, customs clearing agent business plan.

This policy further allows potential threats to be identified before a customs clearing agent business plan is loaded at the foreign seaport, which enables Customs to i. prevent the cargo, if posing a threat, from entering the port in the Republic. The decision to reduce the period for submission of clearance declarations in the CCA is informed by technological advances since when the current Act was drafted.

Trade and the way business is conducted have dramatically changed since then and in the current electronic environment information required for clearing goods is available instantly. To mitigate the effect of the reduced timeframe, provision is also made for clearance and release of goods on submission of incomplete or provisional clearance information, customs clearing agent business plan.

The requirement was inserted to facilitate planning of the supply chain. SARS will be in a position to determine the risks the goods pose before arrival if a clearance declaration is submitted three days prior to arrival. Once SARS has determined the risk, SARS will issue a notification provisional release to inform parties where the container must be removed to upon arrival i. to a depot in Durban or a terminal in Johannesburg.

The trader can therefore make the necessary logistical arrangements for transport of the goods with certainty prior to the arrival of goods. Upon arrival, the goods will be released to or detained at the place indicated in the provisional release. The provisional release falls away if the goods are detained and is replaced by the notice of detention which will indicate the place where the goods are to be removed to. The difference can best be described with reference to the consequence of release.

Goods released for home use become goods in free circulation, in other words goods over which Customs no longer exercises control. Goods released for a customs procedure will remain subject to customs control as goods not in free circulation and the provisions of the Act which are applicable to that procedure must be complied with.

The customs authority cannot release goods that have not physically arrived at a place of entry of entry or exit.

The tax status of goods is either tax due or tax free. A tax due status indicates that tax will be payable on goods if tax is imposed in terms of a tax levying Act on goods of that kind.

A tax free status indicates that while goods have a tax free status, no tax will be payable on the goods if tax is imposed in terms of a tax levying Act on goods of that kind. Tax includes customs duty, excise duty, VAT and any other tax payable on the import or export of goods. The rationale for changing the existing policy is based on the fact that SARS can customs clearing agent business plan effectively control the movement of goods across our borders and the risk it poses if it has the necessary information.

A manifest is a summary of cargo on board a vessel and it only provides a general description of the goods e. It does not contain the tariff, value and origin information which is required to determine risk.

The information on the transport document is merely based on information supplied to the carrier by a person in a foreign jurisdiction. In contrast, a clearance declaration is submitted by a registered person or licensee or a registered agent located in the Republic and contains the tariff, value and origin information necessary to determine risk. That person also declares the truth of the information in a clearance declaration.

As that person commits to the correctness of the information relating to the clearance of the goods, he can be held liable if a false declaration is made. Business had to be conversant with two different regulatory frameworks.

The CCA now simplifies the regulatory framework by providing that all good entering or leaving the Republic are imports and exports subject customs clearing agent business plan a uniform set of rules. Furthermore, in other Customs Unions, goods entering or leaving member states are regarded as imports and exports respectively. Clearances for some customs procedures in certain circumstances are not permissible e.

international transit is not permissible after warehousing, but the goods should rather be cleared for export. Yes, as existing customs registrations and licences will lapse 30 days after the effective date of the CCA if the holder thereof has not submitted a new application for registration or licence within that period.

Existing excise registrations or licences are not affected by the enactment of the CCA and such clients do not have to apply for registration or licensing in respect of activities regulated under the Excise Duty Act after the effective date. SARS anticipates opening applications for registration and licensing a reasonable period before the effective date of the CCA.

An existing registration or licence continues to be effective in terms of section or of the CCA until the new application is finalised, customs clearing agent business plan. Provided clients submit their new applications within 30 days after the effective date, they can continue to operate under their existing registration or licence, customs clearing agent business plan. SARS will be planning our capacity and service channel offerings to ensure optimal efficiency during this time.

This date is still to be determined by the President. On that date the Customs and Excise Act, customs clearing agent business plan, customs clearing agent business plan, will in its amended form, be renamed the Excise Duty Act, It will cover matters relating to excise, fuel levy, RAF levy, environmental levy as well as air passenger tax.

In other words, the two new Customs Acts will replace the provisions of the current Customs and Excise Act, customs clearing agent business plan,in relation to customs only and the amended Act will continue to apply to excise duties and the other levies and taxes mentioned.

No, it is not mandatory to re-register every three years, see section of the CCA which deals with the period of validity of registration certificates.

Subsection 1 expressly provides that a registration certificate remains in force unless it is withdrawn or it expires due to the inactivity of the registered person for a period of three years. In the case of an inactive registered person referred to in section 2an application for renewal must be made in terms of section 1.

No, a lenient approach will be applied for a limited period but the amounts as contained in the penalty table will not be reduced. Initial feedback from trade on the fixed penalty table was considered. It is to be noted that the fixed amount penalty tables for the Customs Duty Act, the Customs Control Rules, customs clearing agent business plan, and the Customs Duty Rules must still be finalised and published for public comment.

The CCA anticipates in sections 2 and 2 that a link will be maintained between the registration or licence in terms of the current Act and the registration or licence in terms of the CCA. How this link will be maintained is the subject of current systems development. The CCA provides that the customs authority is the final release authority i.

If the goods are cleared prior to arrival, the notice of detention to the OGA and the customs broker can be communicated prior to arrival to facilitate the process. Section 90 1 a of the CCA provides that a clearance declaration must be submitted to the customs authority if the goods were imported on board a foreign-going vessel, within three working days of arrival of the goods at the customs seaport where the goods are to be off-loaded from the vessel.

However, please also note the provisions of section 90 4 which requires a clearance declaration in respect of containerised goods that are consigned for delivery to licensed container terminal or depot situated inland e.

City Deep to be submitted at least three calendar days before arrival of the goods at the customs seaport. The submission of a clearance declaration within the prescribed periods does not include release but it must have been accepted by the customs authority in terms of section In other words, the customs clearing agent business plan will stay at the customs controlled area, customs clearing agent business plan, and could be kept in temporary storage.

If the customs authority for some reason decides to detain the goods in terms of Chapter 34 of the CCA, the goods must in terms of section either be kept at the premises where they were detained, or removed to a State Warehouse or to licensed premises determined by the customs authority. The new registration and licence application system is still in the process of development by SARS.

Once the system has been tested and proven stable, SARS will give adequate notice to all stakeholders about its availability for the submission of applications in terms of customs clearing agent business plan Customs Control Act, It is not clear whether this question relates in particular to storage of goods under warehousing procedure at a redirected place.

It is to be noted that redirections may be authorised in relation to goods under other customs procedures as well, eg. section transitcustoms clearing agent business plan, excise warehouse transitinward processing and 2 home use processing. Section must be read with rule 5. The effect of section is that the customs authority may, when granting an authorisation, also determine the period for which the authorisation applies.

This however does not mean that the customs authority may allow goods under a redirection authorisation to remain at a redirected place for a period which is in conflict with an express provision of the CCA. Section 1 b specifically states that the time period must be consistent not in conflict with the CCA and any applicable tax levying Act.

Please see the specific time periods applicable in relation to transit operations, warehousing, inward processing and home use processing in the relevant Chapters of the CCA. Multiple invoice numbers could be accommodated on a declaration. A vessel docks when it arrives at a dock and drops anchor, i. the normal dictionary meaning of the word applies.

The person clearing the goods: see section 2 of the CCA. In its current form, customs legislation is unable to respond to new risks, is not business friendly and needs to be easier to understand and use to provide certainty to traders and travellers as well as to Customs.

Please note: The Frequently Asked Questions FAQs and their answers are intended as general guidance in relation to the new customs legislation. They are not meant to go into the precise technical and legal detail that is often associated with customs. They should, therefore, not be used as a customs clearing agent business plan reference.

They are compiled from queries sent in to the [email protected] mailbox by members of the public. To access this page in different languages click on the links below:. Home About SARS Types of Tax Legal Counsel Contact Us Tax Rates Tax Season Menu.

Businesses and Employers, customs clearing agent business plan.

HOW TO START AS AN EXPORT IMPORT AGENT/ BROKER

, time: 7:09Importing Honey to USA: What You Need to Know | USA Customs Clearance

Jun 01, · Before you can get in on this $ million-dollar industry, you’re going to need to understand the laws and regulations for importing honey into the USA in the first blogger.com Food and Drug Administration (FDA) is the federal government agency in charge of regulating imports of food products into the United States, including honey.. There are several things that you will need to do Sep 16, · Moving your business to the UK. There are processes that can make clearing customs quicker and easier to manage if you have to make import declarations regularly. Your customs agent or Clearing may pay a portion of the revenues or fees derived from servicing my Account to third parties that provide services to you or Clearing. If my Account is an IRA or other retirement plan account, my Account may be charged fees that the particular plan has authorized to be paid to service providers other than you or Clearing

No comments:

Post a Comment